An SBA consultant is a professional advisor who helps small businesses navigate the resources, programs, and loan application processes of the U.S. Small Business Administration (SBA). Their primary role is to provide expert guidance on business planning, compliance, and financing strategies to increase the likelihood of securing SBA-backed funding and achieving long-term growth.

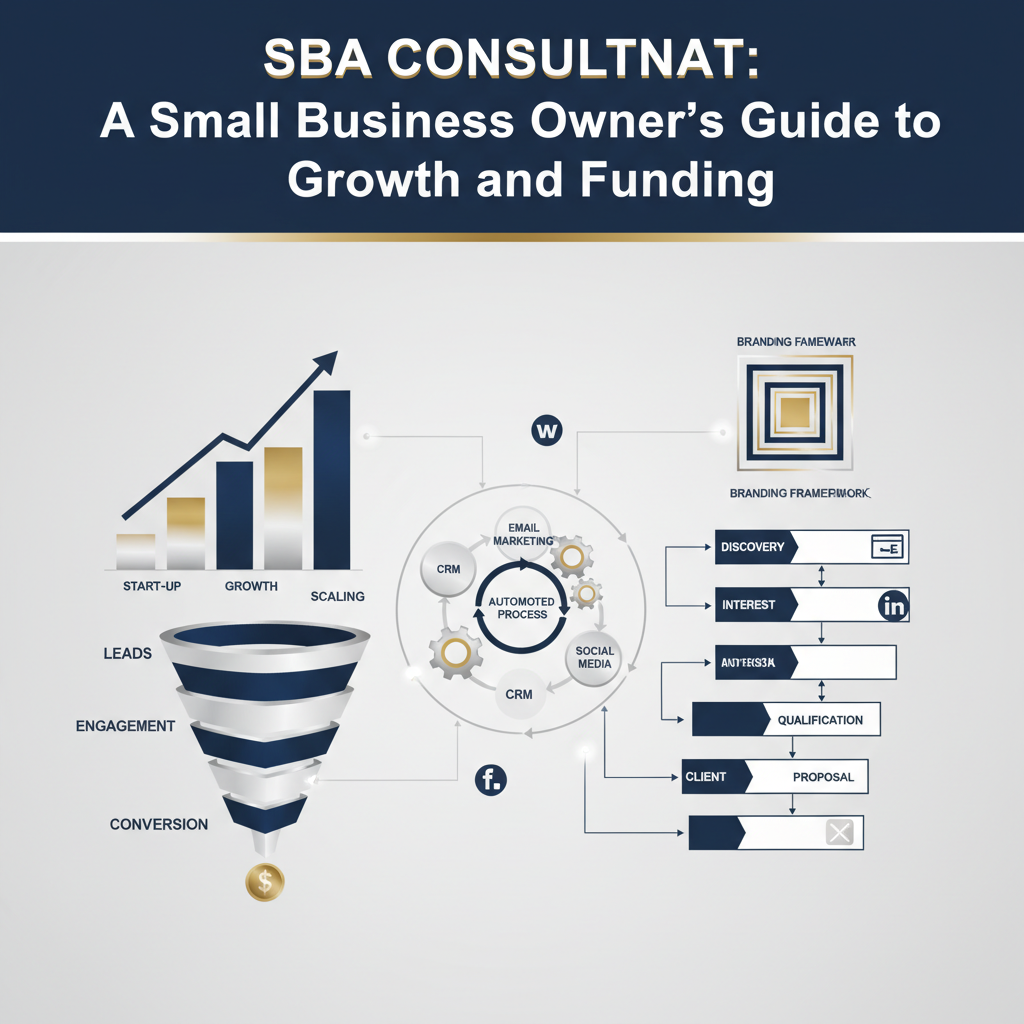

Many ambitious entrepreneurs and small business owners struggle to scale their business while also trying to secure funding. Achieving consistent small business growth can feel overwhelming when you’re juggling marketing, operations, and lead generation. Small Business Administration (SBA) loans can be a game-changer, but the application is known for its complex rules and paperwork. This is where an expert SBA consultant can be a huge help.

An experienced SBA consultant is a strategic partner who simplifies the process of getting federal funding. They help position your business for long-term success, not just loan approval. A consultant provides expert guidance to create a strong business plan, meet all requirements, and present your company well to lenders. This guide explains what an SBA consultant does, how they help you get funding, and when their expertise is key to improving your operations and speeding up your small business growth.

Getting funding is just the first step. Real small business growth also depends on having efficient systems and a strong online presence. An SBA consultant can help you get capital, but your long-term success is what truly matters. This means showing predictable revenue with tools like automated sales funnels, nurturing leads, and keeping a professional online store. We’ll explore how business automation and solid online business solutions support your funding goals. Once you have the capital, these systems will help you make the most of every opportunity, scale effectively, and succeed.

What is an SBA Consultant?

Defining the Role of an SBA Advisor

An SBA consultant, or advisor, is an expert who helps small businesses with Small Business Administration (SBA) programs. Their main goal is to help you get the funding and resources you need to succeed.

These advisors know the different SBA loans inside and out, like the popular 7(a), 504, and Microloan programs. They understand the strict eligibility rules and application steps, which helps you avoid mistakes and get approved faster.

But an SBA consultant does more than just help with funding. They are also important for strategic business development. If you’re struggling to grow online or find a clear direction, a consultant can help. They assist you in setting clear goals and creating a strong business plan, which is often required for a loan application. To give you an idea, the SBA approved over 57,000 7(a) and 504 loans in fiscal year 2023 [1]. An advisor can help you become one of the businesses that gets approved.

Their help is a huge benefit for growing businesses. They take complicated rules and break them down into simple, manageable steps. With their support, you can spend less time on paperwork and more time running your business. An SBA advisor helps you build a solid foundation for scalable business processes and future success.

The Difference Between an SBA Consultant and a General Business Coach

SBA consultants and general business coaches both provide helpful support, but they focus on very different things. Knowing the difference helps you pick the right expert for your business.

An SBA consultant offers very specific help with government-backed programs, like SBA funding, grants, and certifications. They have a deep understanding of the rules and regulations. Their main goal is to help you get these specific resources. Think of them as your guide through the official process, helping you avoid common mistakes on applications.

On the other hand, a general business coach offers wider support for your overall business strategy. They might give advice on leadership, operational efficiency, team building, or marketing basics. While helpful, they usually don’t have detailed knowledge of SBA programs. Their goal is to improve your business’s general performance, often by offering motivation and helping you set long-term goals.

Consider this comparison:

| Aspect | SBA Consultant | General Business Coach |

|---|---|---|

| Primary Focus | Getting SBA loans, grants, and certifications. Meeting government rules. Setting up business processes for funding. | Big-picture business strategy. Day-to-day operations. Leadership and personal growth. General growth strategies. |

| Key Expertise | Government programs and rules. Details of loan applications. Creating business plans for lenders. Showing loan viability with digital marketing. | General business skills. Finding your place in the market. Sales and team management. Mindset and online tools. |

| Outcome Goal | Winning SBA funding or government contracts. Proving your business can make money. | Increasing profits and efficiency. Reaching personal and business goals. Setting up automated sales systems. |

| Approach | Step-by-step, technical, and focused on rules. A process-driven approach based on expert knowledge of funding. | Big-picture, strategic, and motivational. Offers a wide range of advice on productivity and saving time. |

Both experts are helpful, but an SBA consultant is necessary when you need government funding. A coach is better for general growth and improving operations. Automated-Biz works with both. We give you the tools to run an efficient online business, including a professional website, automated sales funnels, and smooth operations. These things are key to proving your business is a good investment for lenders and for succeeding after you get funding. Whether you’re applying for a loan or growing your business, you can automate your work and increase your revenue.

What Key Services Does an SBA Consultant Provide?

Navigating SBA Loan Applications (7(a), 504, Microloans)

Getting an SBA loan can be a game-changer for your small business. However, the application process is often long and complicated. Many entrepreneurs struggle to grow their business because of limited funding or too much paperwork.

An expert SBA consultant makes this process easier. They are experts in the various SBA programs, including 7(a) loans, 504 loans, and microloans. They help you choose the best option for your business goals.

Key services in this area include:

- Finding the Right Program: Helping you find the most suitable SBA loan program for your business.

- Document Preparation: Guiding you as you gather and organize all the required paperwork, so nothing is missed.

- Financial Structuring: Helping you create accurate financial projections and statements, which are critical for lenders to review.

- Lender Communication: Connecting you with approved SBA lenders and helping manage communication throughout the process.

- Application Review: Carefully checking your complete application to reduce errors and improve your chances of approval.

This expert help saves you valuable time and greatly improves your chances of getting the funding you need. For example, the SBA approved over 50,000 7(a) loans in fiscal year 2023 [2]. An SBA consultant can help you become one of them.

Developing a Compliant and Compelling Business Plan

A good business plan is more than just a document—it’s your roadmap for growth. For SBA loan applications, your plan must be both persuasive and follow all of the SBA’s strict guidelines.

Many business owners are busy with day-to-day tasks and may not have the expertise to write a plan that impresses lenders. An SBA consultant can help. They work with you to explain your vision in a clear and convincing way.

An SBA consultant provides hands-on support for:

- Market Analysis: Researching your target market to identify your ideal customers and what makes you different from competitors.

- Financial Projections: Creating realistic financial forecasts, including profit and loss statements and cash flow projections.

- Operational Strategy: Outlining your business model, management structure, and day-to-day operations.

- Compliance Assurance: Making sure your plan meets all SBA requirements to avoid common mistakes.

- Value Proposition: Clearly stating what makes your business special to attract lenders and investors.

This detailed planning builds trust and shows lenders you have a clear path to success. A strong business plan isn’t just for getting a loan—it’s a tool that guides your business as it grows.

Assistance with Government Contracting and Certifications

Government contracts are a big opportunity for small businesses, but the process of getting them can be confusing. Many companies looking for new customers overlook this profitable area.

An SBA consultant can help you enter this market. They guide you through the complex rules for federal, state, and local contracts, from checking your eligibility to preparing your bid.

Their support often includes:

- Opportunity Identification: Helping you find government contracts that match what your business does.

- SAM.gov Registration: Assisting with your registration in the System for Award Management (SAM.gov), which is required for federal contracts.

- Certification Support: Guiding you through certifications like Women-Owned Small Business (WOSB), Service-Disabled Veteran-Owned Small Business (SDVOSB), and the 8(a) Business Development Program. These can give you an edge over the competition.

- Proposal Development: Providing expert advice on how to write winning proposals that increase your chances of success.

- Compliance & Strategy: Making sure you understand and follow all government contracting rules, while also helping you plan for long-term success.

Winning government contracts can bring in more money and create a steady income for your business. A consultant turns a complicated process into simple, clear steps.

Strategic Guidance for Business Growth and Compliance

Beyond funding and contracts, an SBA consultant offers expert advice to help your small business grow in a healthy way. This includes dealing with complex rules and changing market trends.

Many business owners want to automate tasks to save time, but they need help with their online operations. A consultant provides the overall strategy. Automated-Biz then provides the tools to put that plan into action.

A consultant’s strategic guidance covers:

- Market Expansion: Advising on entering new markets, creating new products, or offering new services.

- Operational Efficiency: Identifying ways to use automation and improve processes to work more efficiently.

- Regulatory Adherence: Helping you stay compliant with SBA guidelines and other industry rules.

- Financial Management: Providing advice on managing cash flow, creating budgets, and improving financial performance.

- Risk Mitigation: Helping you spot and plan for potential business risks.

This expert advice helps you move from guesswork to a clear plan for your business. It sets you up to grow smoothly. While a consultant gives you the strategy, Automated-Biz provides the tools you need. This includes professional branding, website creation, automated sales funnels, and lead generation strategies. This combination helps your business run more efficiently, grow smarter, and earn more revenue. You get a professional online presence and can better support your clients, leading to steady growth.

When Should You Hire an SBA Consultant?

When You’re Seeking SBA Funding for the First Time

Understanding SBA loans can feel confusing. Many small business owners feel overwhelmed by the application process. An SBA consultant is a great partner, especially when you’re seeking SBA funding for the first time.

They offer expert help from the start. This makes sure you understand the requirements and pick the right loan for your needs. They also help you avoid common mistakes that can delay or deny your application.

Here’s how an SBA consultant helps first-time applicants:

- Explaining Loan Types: They explain the differences between [3], [4], and Microloans. This helps you choose the best fit for your business growth.

- Creating a Strong Business Plan: A good business plan is very important. Consultants help you clearly explain your vision, market analysis, and financial goals. This shows that your business can succeed and make money.

- Checking Your Application: They carefully check all your paperwork. This reduces mistakes that can slow down approval. Their experience makes the whole process smoother.

- Highlighting Your Strengths: They help you show off the best parts of your business. This includes showing you have a strong online presence and good ways to find new customers.

Automated-Biz supports this by helping you build a professional online presence. Our branding and website services help you look professional and reliable. Also, our automated sales funnels can show how you make money, making your loan application much stronger.

When You Need to Grow Your Business

Getting funding is just the first step. Growing your business the right way is key to long-term success. An SBA consultant gives you important advice that goes beyond the loan. They help you move from just running your business to actually growing it.

They look at how your business works. Then, they find the best areas to improve and grow. This expert review helps you work smarter and plan for the future.

An SBA consultant can help you:

- Use Funds Wisely: Consultants help you decide how to best use new funds. This ensures you make smart investments in areas like technology or new staff.

- Automate Your Work: They can recommend ways to use automation to make your work easier. This is important when you get busier, as it saves time and helps you manage more work without losing quality.

- Improve Your Marketing: To grow, you need to reach new customers. Consultants can help you plan how to get new clients. This includes using today’s digital marketing tools.

- Work More Efficiently: They help improve how your team works. The goal is to get more done with the resources you have. This creates processes that save you time.

Automated-Biz gives you the tools to put these plans into action. Our platform has tools for automated sales funnels and social media. This helps you get new leads regularly and connect with clients easily. We change messy manual tasks into smooth, automated ones, which helps you get new clients in a reliable way.

When Paperwork and Rules Are Overwhelming

The amount of paperwork for a small business can be huge. SBA loan applications, following the rules, and government contracts often involve a ton of confusing paperwork. Many business owners struggle to grow online because they feel overwhelmed by marketing, operations, and these complex rules.

An SBA consultant is an expert at handling these challenges. They guide you through confusing rules and long forms. This support lets you focus on running your business.

An SBA consultant can help by:

- Making Paperwork Easier: They break down confusing forms into simple steps. This lowers the chance of making big mistakes.

- Following the Rules: Following SBA rules is required. Consultants keep you updated and help you keep good records. This helps prevent problems later on.

- Saving Time and Stress: Handing off this work saves a lot of time. It also reduces the stress that comes with all the rules and paperwork.

- Offering Continued Support: They offer help even after your application is done. This makes sure your business continues to follow the rules as it grows.

While an SBA consultant handles the rules and regulations, Automated-Biz handles your other automation needs. We combine technology with practical business plans. Our platform offers marketing services, branding and website creation, and online reputation management. This helps you look professional and trustworthy online while automating your work without sacrificing quality. We help you go from feeling overwhelmed to growing in a smart way, making it easier to find new clients and manage your online work.

Beyond Funding: How to Maximize Growth with Automation

Building a Professional Online Presence to Support Your Loan Application

Getting an SBA loan takes more than a good business plan. Lenders want to see a stable and legitimate business. A professional online presence is key to showing your credibility and potential for growth. It proves you are serious about your business. In fact, many lenders now check your online presence when they review your application.

Think of your online presence as your digital storefront. It shows how professional and reliable your brand is. An old or missing website can be a red flag for lenders. On the other hand, a polished website and active online profiles build trust. Consumers often look up a business online before they buy. In fact, 81% of consumers research online before making a purchase [5].

To build this important online foundation, focus on these key areas:

- Professional Branding and Website Creation: Start with a custom logo and consistent branding to create a recognizable identity. Your website should look modern, work well on phones, and be easy to use. It must clearly describe your services or products. This is your most important digital asset.

- Consistent Online Information: Make sure your business name, address, phone number, and hours are the same everywhere online. Incorrect details can damage your credibility.

- Active Social Media Presence: Keep your social media accounts active. Share interesting content regularly to show you are connected with your audience. It also shows you understand modern marketing.

- Online Reputation Management: Read and respond to customer reviews. A strong online reputation builds trust with both customers and lenders. It shows you care about feedback and customer happiness.

Automated-Biz helps you look professional and trustworthy online. We offer branding and website creation services that work together. Our platform makes sure your digital foundation is strong, polished, and ready to impress lenders.

Using Automated Sales Funnels to Demonstrate Revenue Potential

Lenders need to feel confident that your business can earn money and repay the loan. Managing sales by hand can seem inconsistent. Automated sales funnels, however, show a clear and predictable way you get new customers. This organized approach to growth is very attractive to loan officers.

An automated sales funnel guides potential customers from their first show of interest to becoming a loyal client. This system works on its own, so you don’t lose track of any leads. It also provides a clear way to measure how you generate revenue. Businesses using marketing automation can see a 14.5% increase in sales productivity [6].

Using automation for lead generation helps you:

- Show a Steady Flow of Leads: Automation tracks every potential customer. This data proves you have a reliable system for finding new business.

- Nurture Leads Effectively: Automated emails and content keep potential customers interested and get them ready to buy. This shows lenders you have a clear process to turn prospects into paying customers.

- Forecast Sales with Confidence: Using data from your automated funnels, you can predict future income more accurately. This makes a strong case for your business’s financial health and supports your growth plans.

- Scale Your Business: Automated sales funnels help you manage more leads without more work. This ability to grow is a key sign of long-term success and shows you have smart business processes in place.

Automated-Biz offers complete online business solutions. Our platform has ready-to-use sales funnels. These tools help you get steady leads and show lenders that your business can make money. You can guide clients and increase repeat sales with less effort.

Streamlining Operations for Post-Funding Success

Receiving an SBA loan is a big step. The next challenge is to use that money well. Simplifying your daily work with business automation is key to long-term growth. It keeps you from getting overwhelmed by marketing and operational tasks. Automation saves you time and resources so you can focus on your bigger goals.

Doing everything by hand can create bottlenecks and make it hard to grow. Business automation fixes these problems. It helps you shift from slow growth to scalable processes and from guesswork to expert-guided automation.

Consider automating these key areas of your small business:

- Marketing Automation: Schedule social media posts, manage email campaigns, and automatically follow up with leads. This keeps your communication consistent without you doing it all by hand.

- Client Relationship Management (CRM): Automatically welcome new clients, set follow-up reminders, and track conversations. A good system enhances customer satisfaction and keeps them coming back.

- Online Reputation and Review Management: Automatically ask customers for reviews, gather all your feedback in one place, and respond quickly. This helps you maintain a positive brand image.

- Administrative Tasks: Automate tasks like sending invoices, scheduling appointments, and entering data. These simple workflows can save a lot of time. Businesses can save up to 30% of their time by automating repetitive tasks [7].

Automated-Biz is your all-in-one platform for marketing and sales. We help you automate your work while keeping quality high. Our tools simplify your entire operation, ensuring your business runs efficiently, grows smarter, and earns more revenue before, during, and after your funding journey.

Frequently Asked Questions About SBA Consultants

What is a typical SBA consultant salary?

Most SBA consultants are independent professionals or part of a firm, so they don’t earn a typical “salary.” Instead, they are paid fees for their expert services.

These fees can vary a lot. The final cost depends on the consultant’s experience, location, the project’s difficulty, and the exact services you need. For example, help with an SBA 7(a) loan application will have a different price than creating a full business plan development for small business growth.

Common SBA Consultant Fee Structures:

- Hourly Rates: Many consultants charge by the hour. This can range from $100 to over $300 per hour, based on their expertise.

- Flat Project Fees: For a specific project, like completing an SBA loan package, a consultant might charge a single flat fee. This makes it easy for business owners to budget.

- Retainer Fees: For long-term help or bigger projects, you might arrange a monthly retainer.

While prices change, the average hourly rate for a business consultant is often between $100 and $250 [8]. SBA specialists may charge more because of their specific skills and successful track record. It’s important to think about the long-term value. A good sba consultant can help you avoid expensive mistakes and greatly improve your chances of getting the funding you need. This often means you get a great return on your investment in your small business growth.

At Automated-Biz, we know that hiring an expert is a big investment in expert support. While our focus is business automation and building your professional online presence, getting an SBA loan requires showing your business is ready to operate well and make money. Our services, from branding and website creation to automated sales funnels, are designed to strengthen these exact areas.

How do I find an SBA consultant near me?

Finding the right sba consultant is a smart step for any business owner who needs funding or guidance for small business growth. Here is a simple, step-by-step guide to help you find a qualified expert:

1. Use Official SBA Resources:

- SBA Website: Start at the official Small Business Administration website. They often have lists of resources to help you find local assistance.

- SBDCs (Small Business Development Centers): These centers offer free or low-cost advice and training. They can often refer you to a trusted sba consultant in your area [9].

- SCORE Mentors: SCORE is a non-profit that provides free mentoring and workshops. Its experienced mentors can guide you and recommend good consultants.

2. Search Online Effectively:

Use specific, detailed phrases (often called long-tail keywords) to get better search results. This will help you find local experts. Try searching for:

- “SBA loan consultant near me”

- “Small business funding advisor [your city/state]”

- “SBA 7(a) loan application assistance”

- “Business plan writer for SBA loans”

3. Ask for Referrals:

Networking is powerful. Speak with other small business owners, bankers, accountants, or attorneys. They can often provide trusted recommendations based on their own experiences.

4. Check Their Background and Experience:

Once you have a shortlist, check them out carefully. Look for a consultant with a history of successfully getting SBA loans for clients or helping with small business growth strategies. Ask about their experience with businesses in your industry.

5. Set Up an Initial Meeting:

Most good consultants offer a free first meeting. Use this time to talk about your needs, see if you communicate well with them, and understand how they work. Have a list of questions ready, such as:

- What is your success rate with SBA loan applications?

- Can you provide client testimonials or references?

- What is your fee structure for my project?

- How do you stay updated on SBA regulations?

- How will you help me with business plan development?

Finding the right sba consultant isn’t just about getting money. It’s about building a strong base for lasting small business growth. After you get your funding, Automated-Biz can help you put smart online business solutions in place. Our platform makes everything easier, from branding and website creation to setting up automated sales funnels and handling your online reputation management. We help you switch from manual work to automated, streamlined operations, so you can make the most of your new funding and attract new clients consistently.

Sources

- https://www.sba.gov/

- https://www.sba.gov/document/report-small-business-lending-data

- https://www.sba.gov/funding-programs/loans/7a-loans

- https://www.sba.gov/funding-programs/loans/504-loans

- https://blog.hubspot.com/sales/local-seo-stats

- https://www.nucleusresearch.com/research/single/roi-case-study-marketing-automation-is-a-must-have/

- https://hbr.org/2021/04/the-power-of-process-automation

- https://www.consulting.com/consulting-fees-and-rates

- https://www.sba.gov/local-assistance/resource-partners/small-business-development-centers-sbdc

Leave a Reply